Unbelievable Info About How To Achieve Diversification

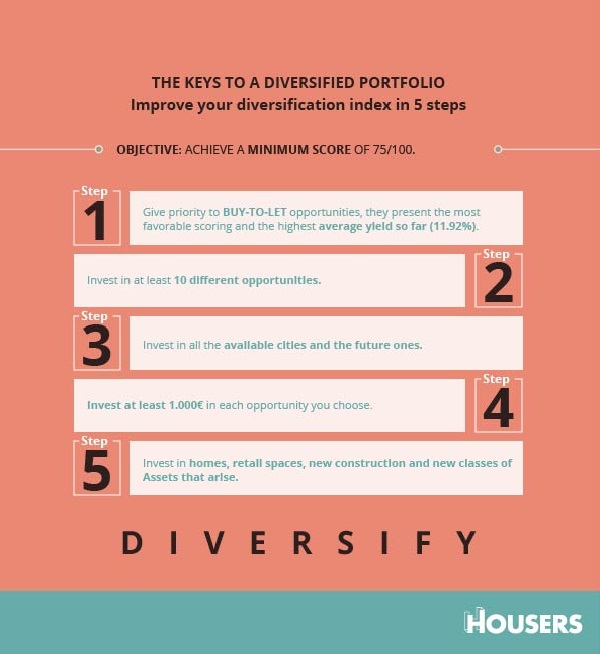

Here are five tips for helping you with diversification:

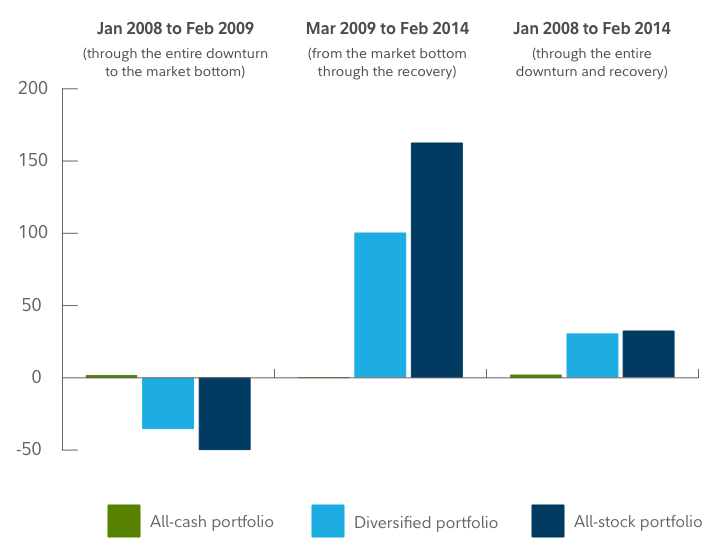

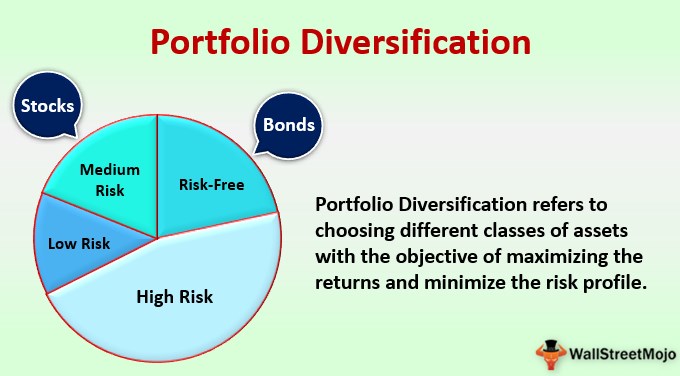

How to achieve diversification. It starts with a few simple steps. Portfolio diversification “stabilizes” returns and trims peaks and valleys for a smoother ride. Diversification is a familiar term to most investors.

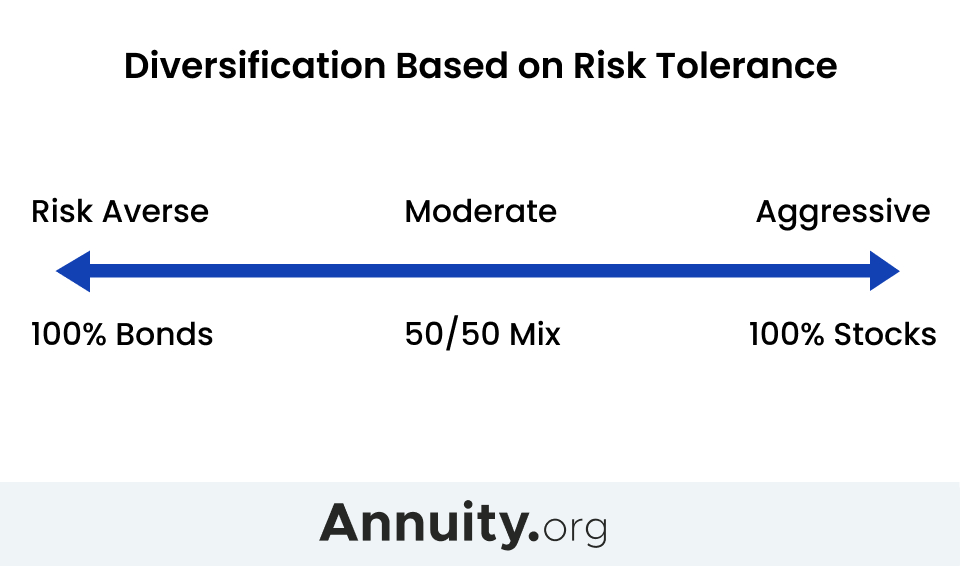

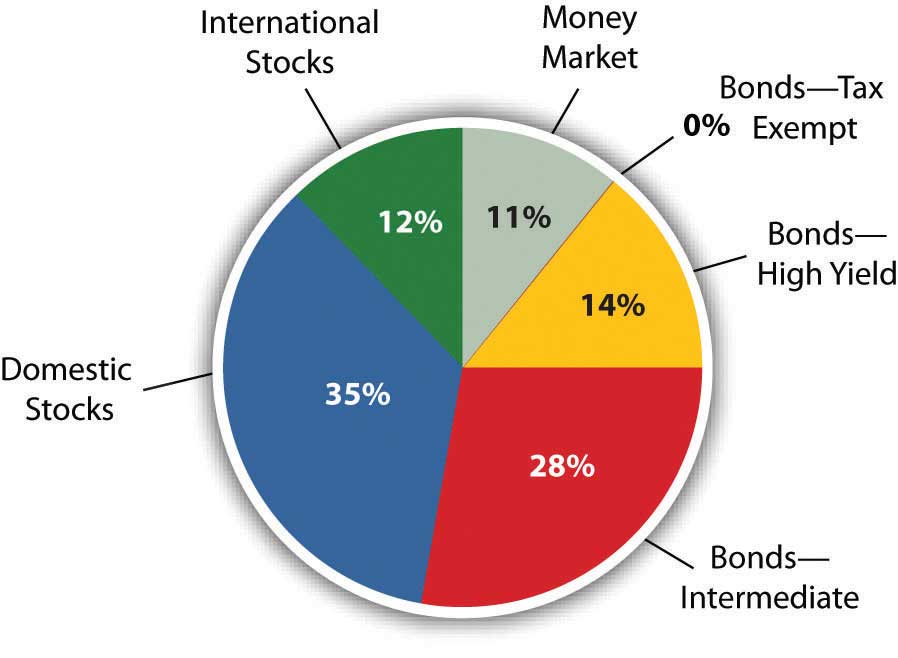

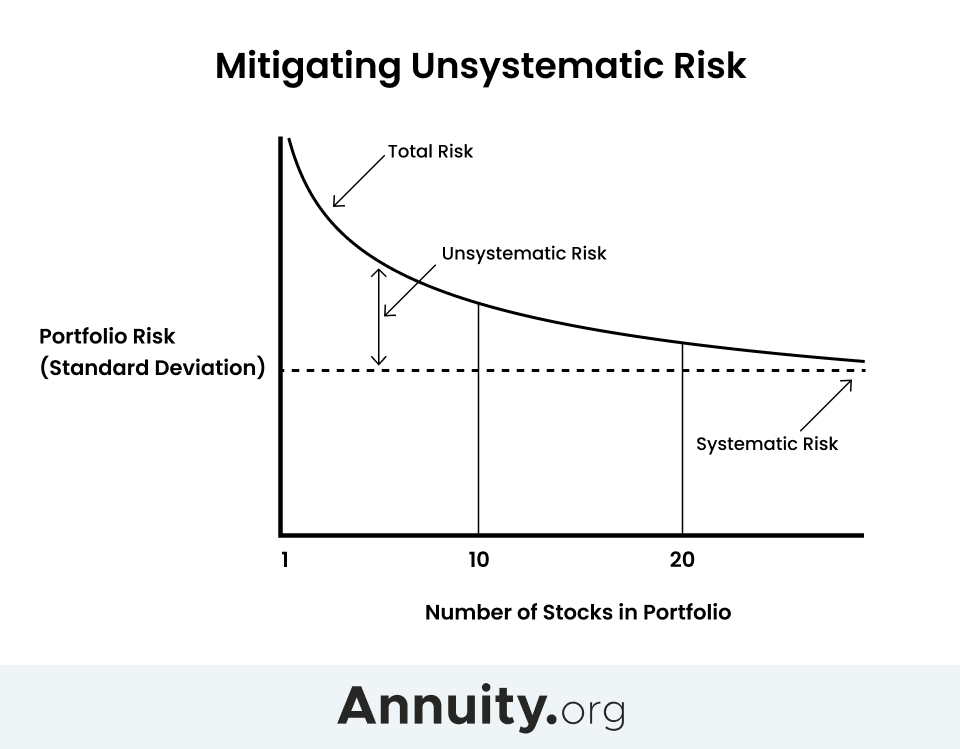

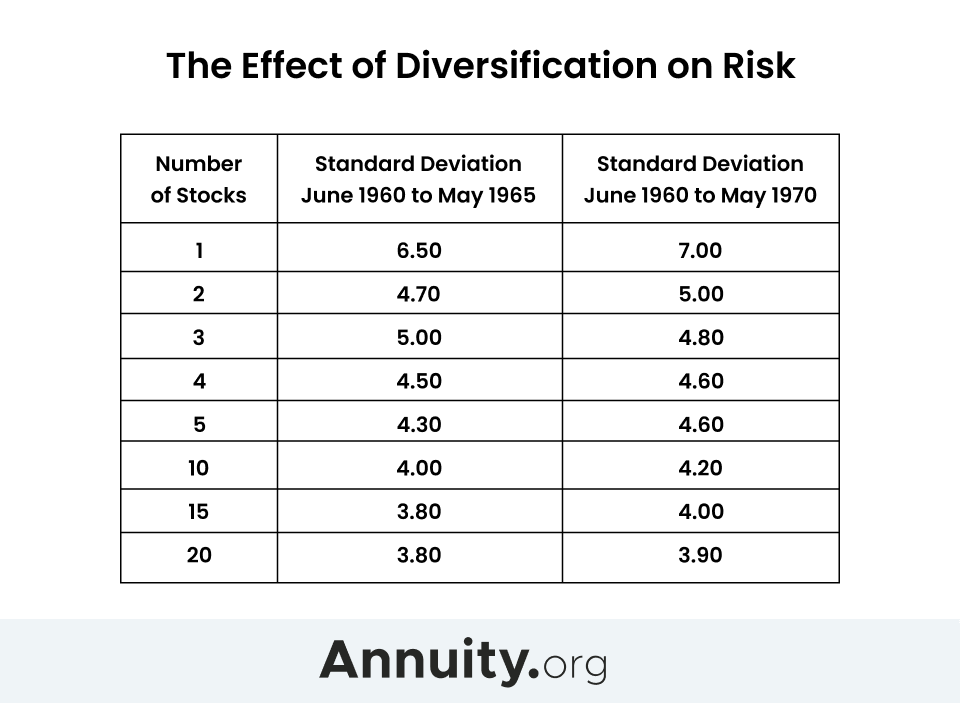

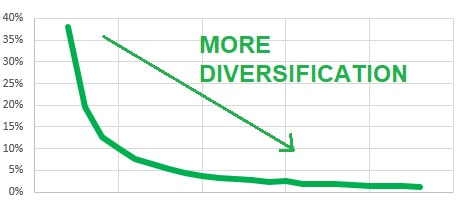

The most conventional view argues that an investor can achieve optimal diversification with only 15 to 20 stocks spread across various industries. Therefore, when developing your investment allocation strategy, including cash is a good way to achieve risk diversification. Diversification does, however, have the potential to improve returns for whatever level of risk you choose to target.

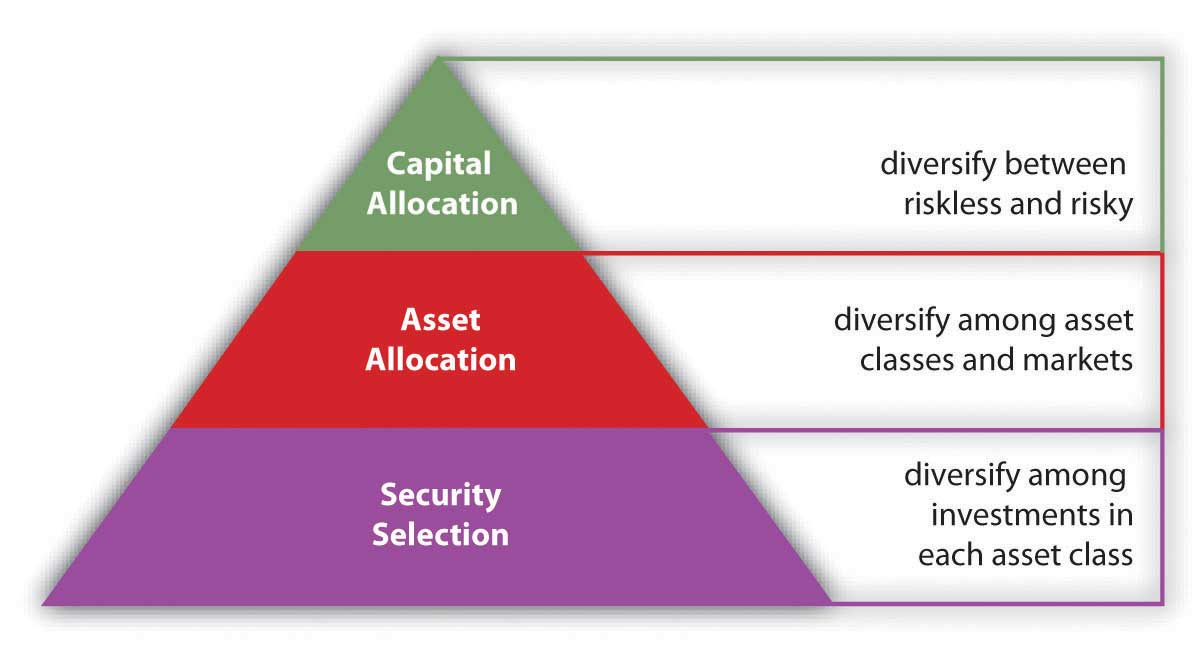

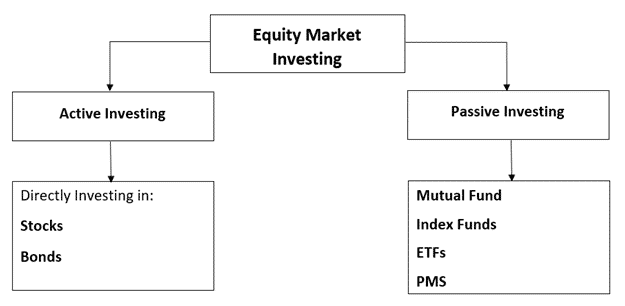

Do whatever allows you to stay the course. We consider 4 main ways to diversify a portfolio: The popular forms of diversification are vertical integration/ horizontal diversification;

Clients are advised to attain diversification in their investment portfolios to ensure that it can support a longer retirement horizon, writes an expert in kiplinger. Diversification is an investment strategy that means owning a mix of investments within and across asset classes. “the way to achieve a balanced.

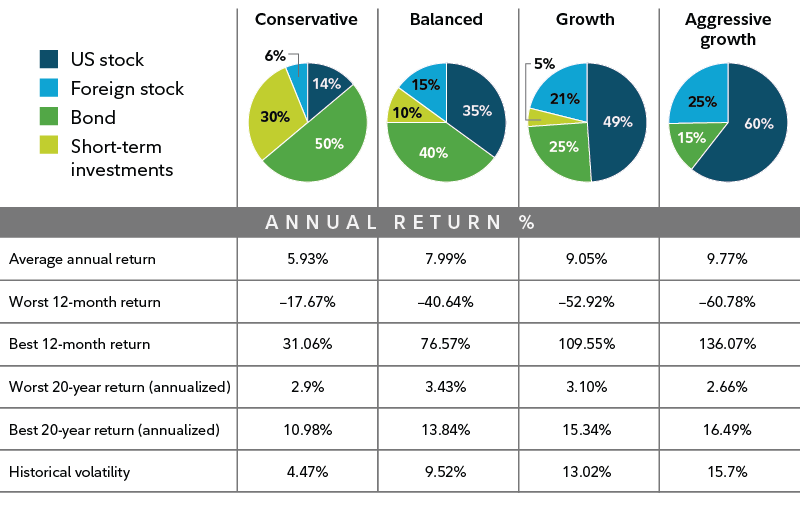

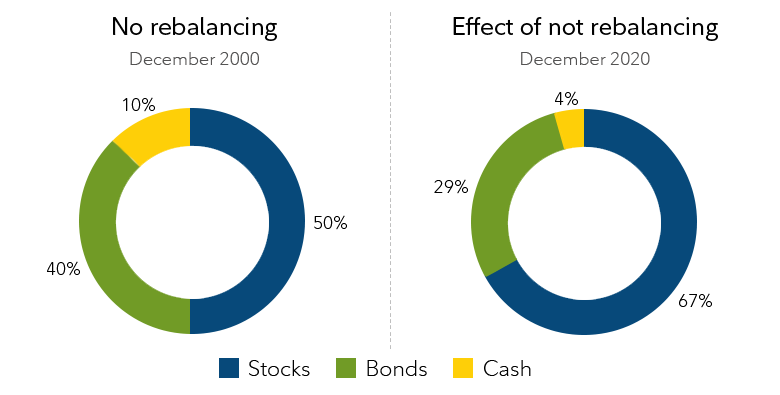

Asset allocation refers to the different weightings of stocks, bonds and cash in your portfolio. To put it bluntly, diversification is the act of spreading your investment dollars across multiple financial institutions and markets which allows you to balance risk among. So, how can your business achieve supply chain diversification?

The primary goal of diversification is to reduce a portfolio's. Vertical integration involves integrating business along with the. One of the most important rule you should follow while investing in different assets for portfolio diversification is to have low or no correlation between those assets.