Fabulous Info About How To Become Cpa Usa

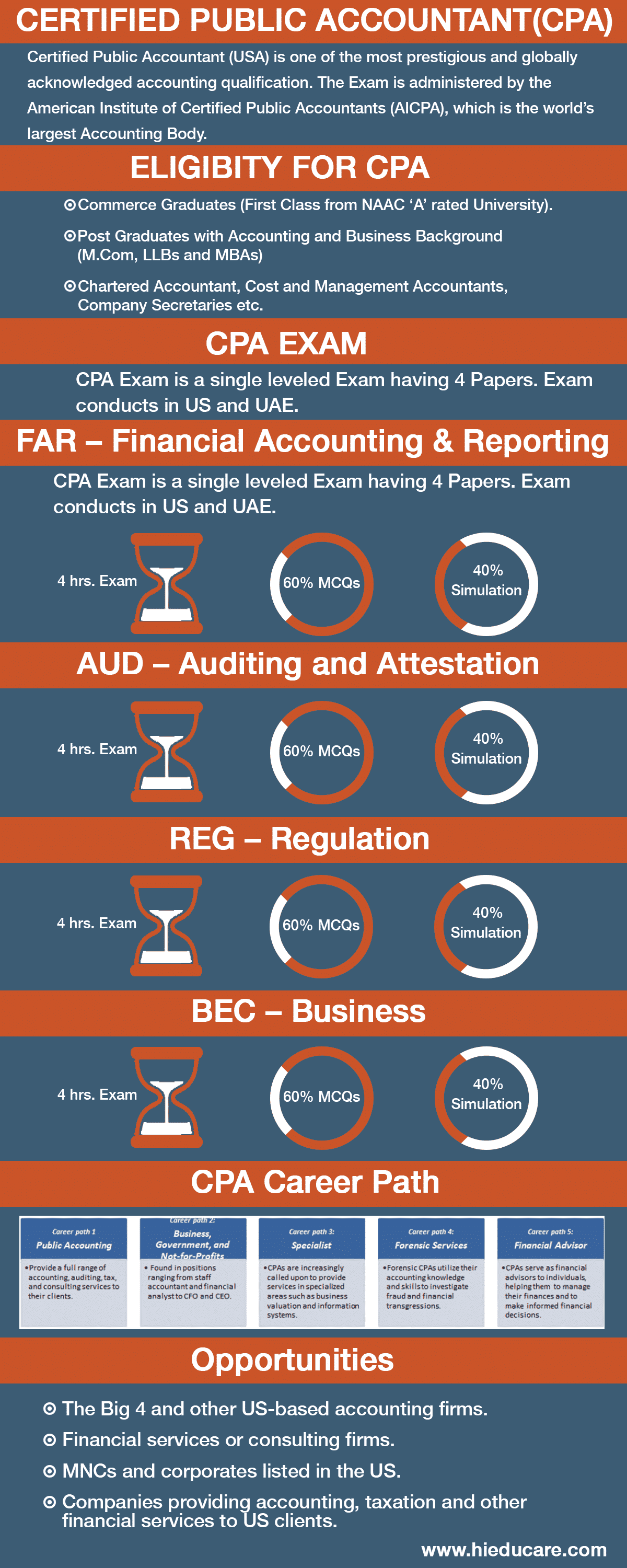

People who are not citizens of the united states may still qualify to become a certified public accountant.

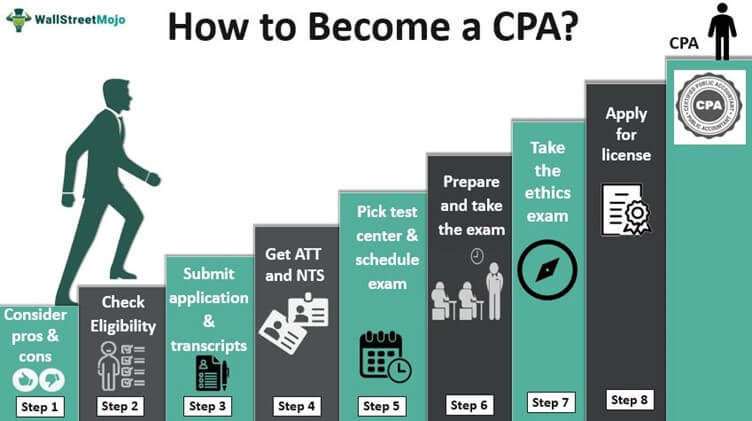

How to become cpa usa. To do this, the state board of accountancy requirements must be. Study for and then pass the cpa exam (passing will be much easier if you know. Get discounts on cpa review courses!

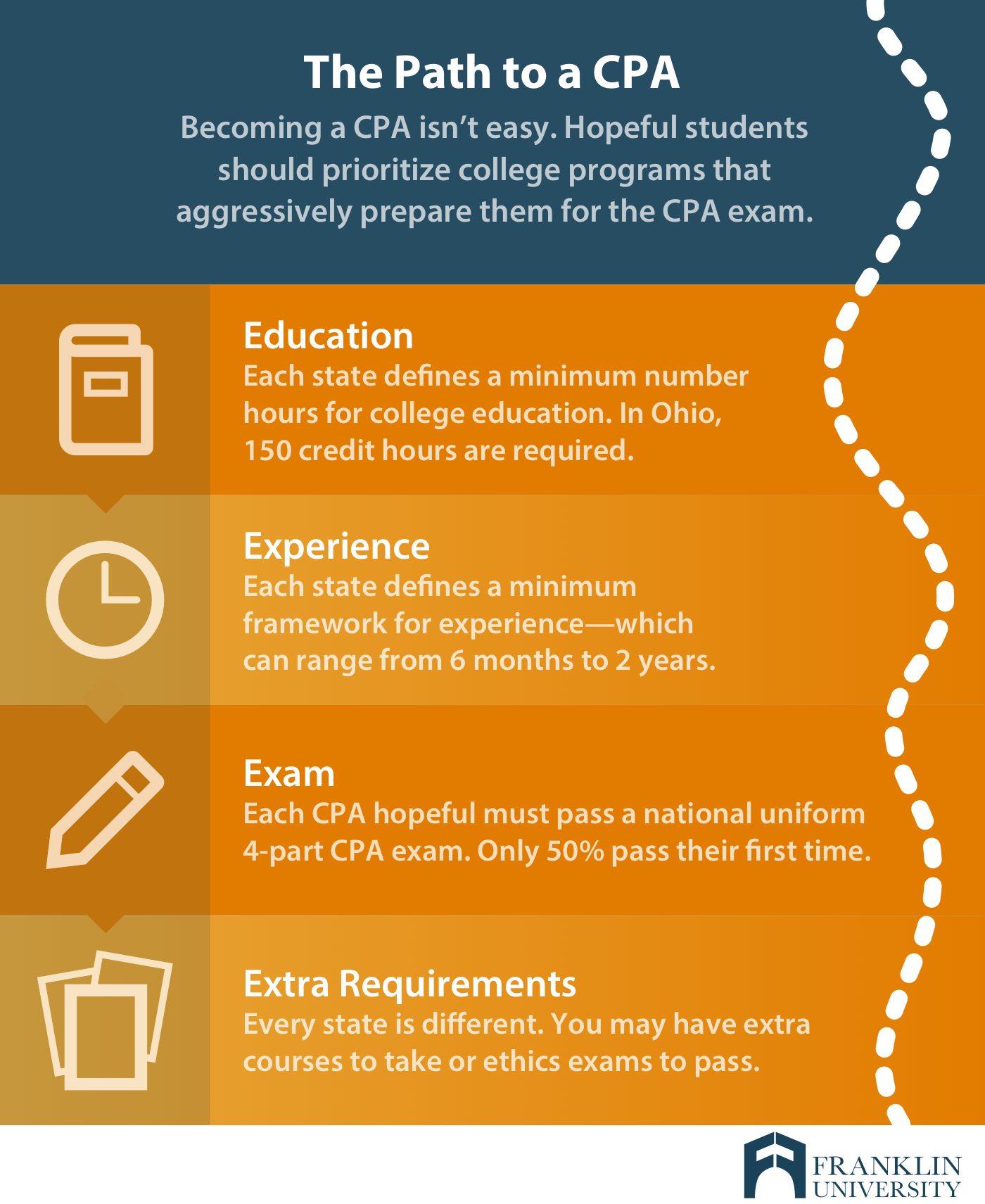

In order for a cpa candidate to earn the license, all state boards require candidates to have a bachelor’s degree, and almost all state boards insist that. To become a certified public accountant, a candidate has to successfully clear all the exams conducted by the american institute of certified public accountants (aicpa). It’s always a good idea to start.

Any candidate wishing to sit for the cpa exam must meet certain educational requirements, though these do vary by jurisdiction so it’s best to. It can be used as general. >> 7 steps to become a cpa being an international candidate <<.

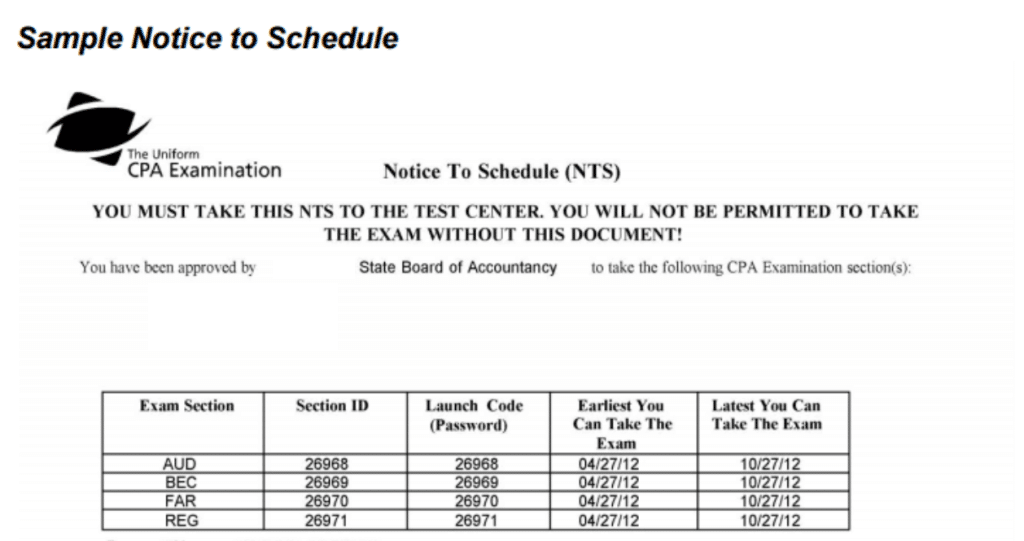

This powerpoint presentation includes information on eligibility requirements, testing, and steps to take toward certification. To become a cpa in the us, a student must pass the exam and meet other state requirements such as gaining a certain amount of work. Three things that can help you ace this taxing exam are careful planning, hard work, and consistency.

The main requirement is that. In my opinion, this is the first step. To become a certified public accountant (cpa) in the usa requires months of practice in education and career accounting as well as years of rigorous work to pass the exams.

Eligibility criteria for the cpa exam. This designation shows an expertise in the field. If you cannot find a state where you can apply to.